If you’re hoping to buy your first home in Downers Grove, Naperville, Warrenville, or anywhere in DuPage County or the greater Chicagoland area, you’re not alone, and you’re definitely not without challenges. First-time homebuyers in the Western Suburbs often face obstacles like limited credit history, high student loan debt, or a small down payment. Add to that the competitive housing market in this region, and the process can quickly feel overwhelming.

But here’s the good news: whether you’re searching in Downers Grove, Naperville, Warrenville, or nearby communities like Aurora or Lisle, there are tools, programs, and strategies that can make homeownership achievable, even if your credit history is thin or nontraditional.

This article will walk you through some of the most common hurdles, the programs that can help, and the new tools from Fannie Mae and Freddie Mac that are changing the game for buyers in DuPage County and beyond.

Understanding the Mortgage Options for First-Time Buyers in DuPage County

When it comes to mortgage loans for first-time buyers, most fall into one of the following three categories.

FHA Loans

Backed by the Federal Housing Administration, these loans are popular among first-time buyers because they allow:

- Credit scores as low as 580 (sometimes even lower with larger down payments)

- Down payments as low as 3.5%

- Flexible debt-to-income (DTI) ratios

FHA loans are easier to qualify for but require mortgage insurance premiums (MIP) for the life of the loan, which can increase long-term costs.

Fannie Mae and Freddie Mac Loans

These are conventional loans that are not government-insured, but backed by government-sponsored enterprises (GSEs): Fannie Mae and Freddie Mac, to promote housing stability. These loans typically:

- Require slightly higher credit scores than FHA (usually 620+)

- Allow as little as 3% down for qualified first-time buyers

- Often offer lower overall costs in the long run due to cancelable private mortgage insurance (PMI)

The bonus? Fannie Mae and Freddie Mac have recently introduced tools that help level the playing field for buyers with thin credit history, nontraditional income, and strong recent rent payment history.

Thin or No Credit History?

Many first-time buyers in the Chicagoland area, especially in diverse communities like Warrenville and Naperville, are financially responsible but haven’t built traditional credit. That’s okay, not everyone builds credit the same way.

If you’ve avoided credit cards or loans, your score might be low or you might not have one at all. This is especially common for younger buyers or those who have avoided using credit in the past, especially renters and those paying bills through cash payment apps like Venmo and Zelle. Lack of a traditional credit history doesn’t necessarily mean you’re not financially responsible. Actually, paying your rent consistently may be a good indicator that you will pay your mortgage consistently too.

That’s where these tools come in.

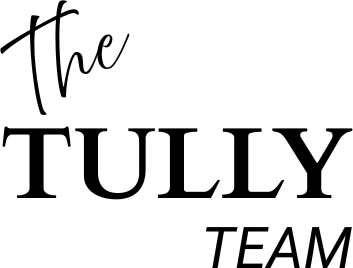

✅ Positive Rent Payment History

Fannie Mae and Freddie Mac allow lenders to include on-time rent payments in your mortgage application even if your credit score is limited. This is huge if you’ve paid rent consistently for the last 12 months.

How it works:

- Rent payments can be verified directly from your bank account using lender-approved systems

- Applies only if you pay rent electronically (not by cash or money order)

- Must have at least 12 months of verified, on-time payments

This is a game-changer for responsible renters looking to become owners.

✅ Freddie Mac’s Cash Flow Assessment Tool

Freddie Mac introduced a “Borrower Cash Flow Assessment” that helps buyers who may not have traditional credit but can show strong cash flow through regular deposits and responsible spending.

How it helps:

- Lenders can review bank data to identify regular income, spending patterns, and financial consistency

- Useful for freelancers, gig workers, or those who don’t have a W-2 job history

- Helps highlight real financial stability, even without a high credit score

Instead of relying only on credit scores, this tool looks at bank data to show consistent cash flow and responsible money management.

✅ Fannie Mae’s Income Calculator

For buyers with nontraditional income, this tool helps lenders determine consistent, qualifying income more fairly and accurately. This tool helps lenders analyze variable income like:

- Multiple part-time jobs

- Hourly wages

- Self-employment or contract work

The Income Calculator helps paint a more complete picture of your ability to repay a loan, especially in the Chicagoland area where many people work flexible schedules. So, your unique income pattern won’t disqualify you just because it doesn’t fit into a neat box.

✅ Asset Verification and Desktop Underwriter Upgrades

Both GSEs offer automated tools that speed up the approval process and reduce paperwork:

- Asset verification uses your bank data to confirm your savings and spending patterns

- Desktop Underwriter (Fannie Mae) and Loan Product Advisor (Freddie Mac) help lenders evaluate applications using broader, more inclusive criteria

- These systems take a whole-picture approach to your finances, they don’t just your credit score

Other Common Mortgage Challenges and How to Handle Them

In addition to thin credit, first-time buyers often face other hurdles. Here’s a few and how to tackle them.

1. High Debt-to-Income (DTI) Ratios

Your DTI ratio compares your monthly debt payments to your income. Student loans and car payments can push your DTI higher than some lenders like. But you still have options. Lenders usually look for a DTI under 43%, but programs vary so don’t rule yourself out before talking to a lender.

What You Can Do:

- Reduce or consolidate debt where possible.

- Look into income-driven repayment plans (Apply for or Manage Your Income-Driven Repayment Plan | Federal Student Aid) for student loans.

- Use a lender familiar with Fannie Mae, Freddie Mac, or FHA, all of which have flexible DTI limits.

2. Low Down Payment Savings

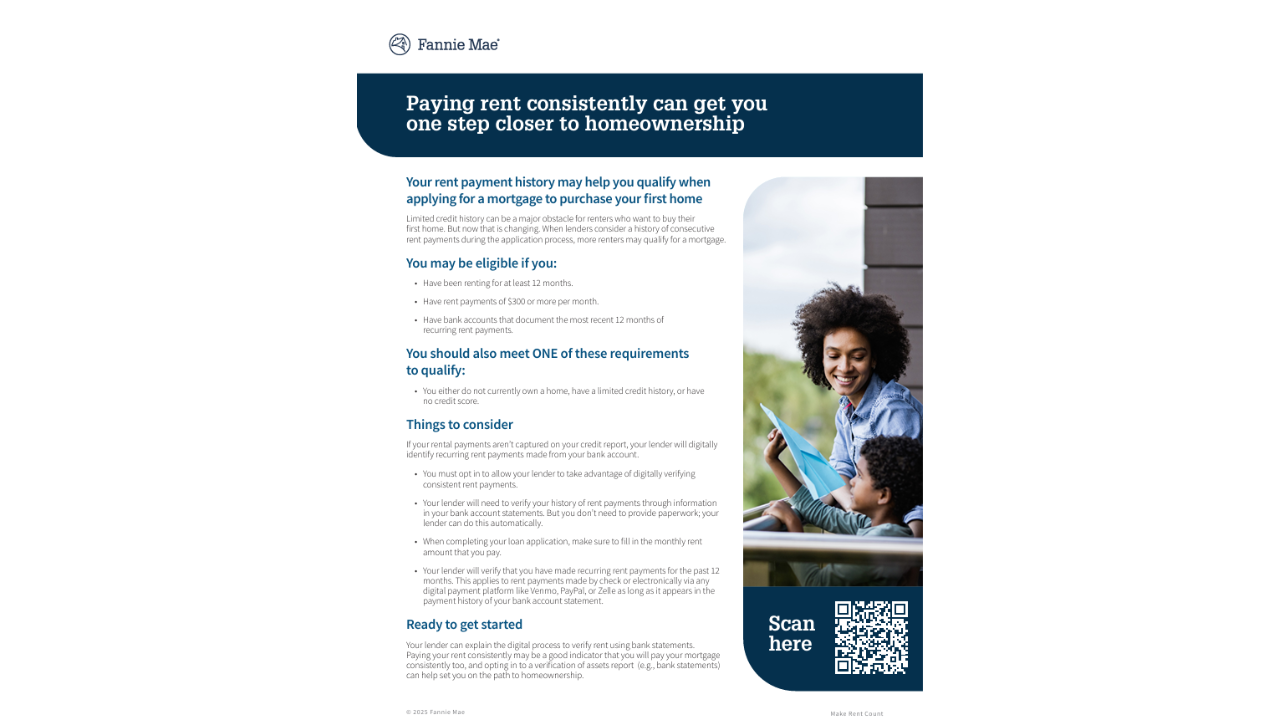

Buying a home doesn’t always mean putting 20% down. In fact, most first-time buyers in DuPage County put down much less. Fortunately, through the Illinois Housing Development Authority (IHDA), Illinois offers programs to help cover your down payment and even some closing costs.

Check out the following IDHA programs at Homebuyer Center | IHDAmortgage.org.

- IHDAccess Forgivable: Up to $6,000 in assistance, forgiven over 10 years.

- IHDAccess Deferred: $7,500 in assistance, paid back when you sell or refinance.

- IHDAccess Repayable: $10,000 as a 0% interest loan, repaid over 10 years.

Note you must work with an IHDA-approved lender to access these programs but they can be used with FHA, VA, USDA, and conventional loans.

Don’t live in Illinois and want to find down payment assistance where you live? Check out Fannie Mae’s Down Payment Assistance Search tool | Fannie Mae.

3. Nontraditional Employment or Self-Employment

If you’re self-employed, a freelancer, or recently changed jobs, it can be trickier to show consistent income. But it’s not impossible. Both Fannie Mae and Freddie Mac offer programs that use asset verification reports to prove your income another way.

What You Can Do:

- Provide two (2) years of tax returns, 1099s, and/or profit & loss statements.

- Keep your personal and business finances separate.

- Use GSE tools like Freddie Mac’s Cash Flow Assessment to help strengthen your case.

4. Confusion About What You Can Afford

It’s tempting to start browsing listings before knowing your price range, but this can lead to disappointment. Pre-approval helps you shop smart from the start.

What You Can Do:

- Get pre-approved before touring homes. This shows what you can afford and helps you move fast when you find the right property.

- Stay realistic. Your first home may not have every item on your wish list, but it can still be the perfect place to build equity and feel at home. Work with a Realtor who listens, understands your goals, and helps you shop smart, not just dream big.

- Prepare for additional expenses. Factor in taxes, insurance, and future maintenance costs, not just your loan payment.

Final Thoughts

Whether you’re buying your first home in Downers Grove, Naperville, Warrenville, or anywhere across DuPage County and the Western Suburbs, know this: it’s not about having perfect credit or a huge down payment. It’s about knowing your options, using the right tools, and building a strategy that fits your goals and lifestyle.

With programs from Fannie Mae, Freddie Mac, and the Illinois Housing Development Authority, buyers in the Chicagoland area have more access than ever to low-down-payment mortgages, down payment assistance, and creative tools to qualify, even with limited credit.

As a local Realtor with The Tully Team at Platinum Partners Realtors, I’m here to help you understand your options, connect you with lenders using these tools, and support you from the first conversation to the day you get your keys.

Want to see what’s possible for you? Let’s chat. There’s no pressure, just helpful guidance and a real plan to get you where you want to go.

Resources:

- Fannie Mae Down Payment Assistance Search Tool: https://www.fanniemae.com/education/down-payment-assistance

- Freddie Mac Borrower Cash Flow Assessment: https://sf.freddiemac.com

- Fannie Mae Income Calculator: https://singlefamily.fanniemae.com

- IHDA Homebuyer Programs: https://www.ihdamortgage.org/homebuyers

- Federal Student Aid Income-Driven Repayment Info: https://studentaid.gov/manage-loans/repayment/plans/income-driven

- Desktop Underwriter (Fannie Mae) Overview: https://singlefamily.fanniemae.com/tools-resources/desktop-underwriter

- Loan Product Advisor (Freddie Mac) Overview: https://sf.freddiemac.com/tools-learning/loan-product-advisor

This article is for informational purposes only and should not be considered legal, financial, mortgage, or tax advice. Please consult the appropriate professionals for advice regarding your individual needs.

Faith Rosenshein Young

Realtor | The Tully Team, Platinum Partners Realtors

Based in Downers Grove, proudly serving Chicagoland

📧 [email protected]

🌐 www.soldbytully.com